Retiree Tax Map – On average Americans have $53,000 in their IRAs and Keogh Plans, according to the Census Bureau. Keogh Plans are a bit like 401 (k)s for self-employed people, but they aren’t super common. These five . Newsweek has created this map using data Bankrate has compiled to provide a detailed ranking of the best and worst states for retirement. .

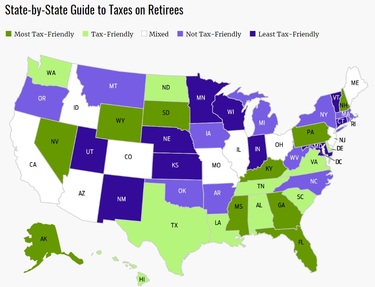

Retiree Tax Map

Source : www.kiplinger.com

State by State Guide to Taxes on Retirees Flagel Huber Flagel

Source : fhf-cpa.com

Retiree Tax Map Reveals Most, Least Tax Friendly States for

Source : www.retirementlivingsourcebook.com

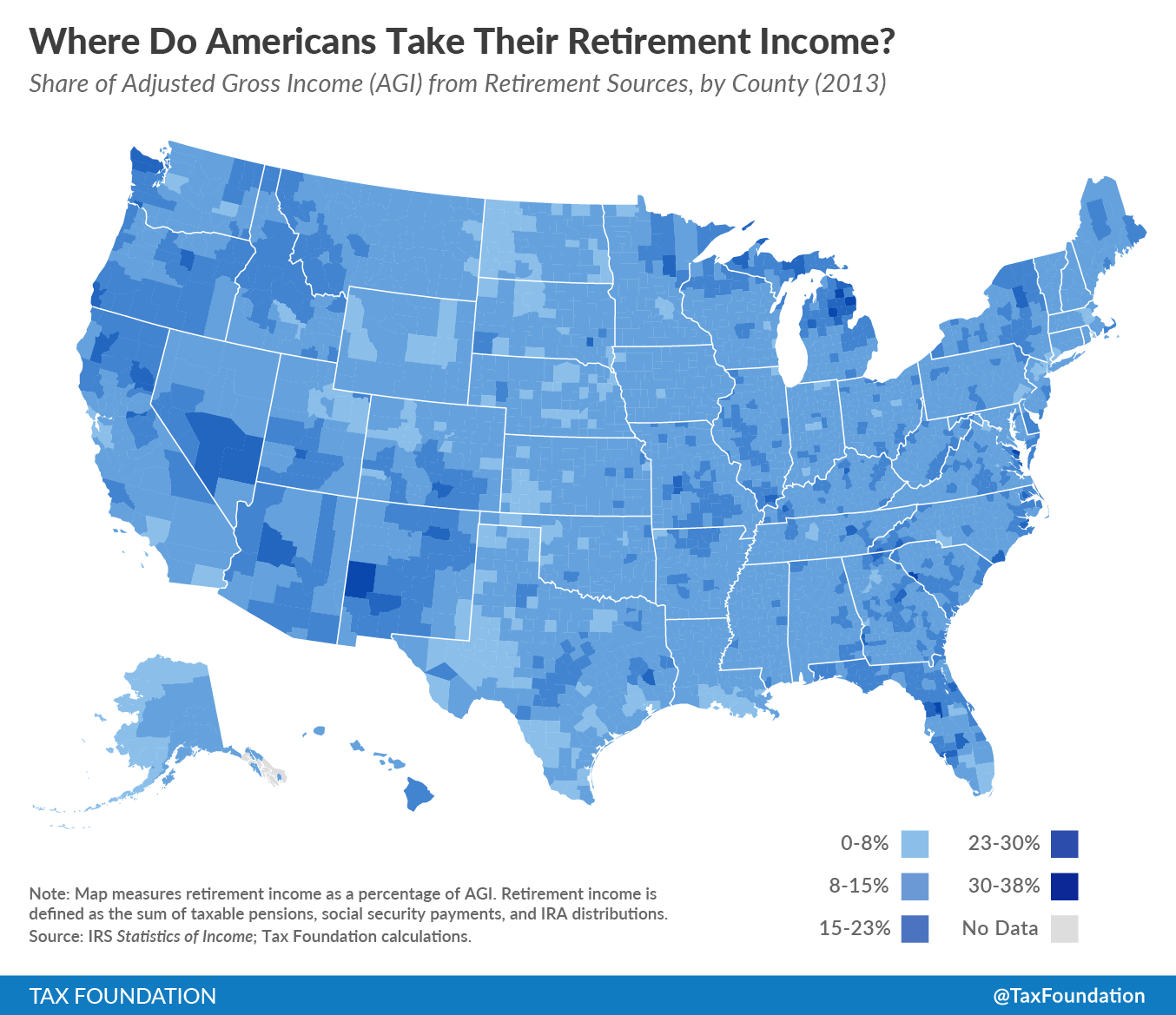

Where Do Americans Take Their Retirement Income?

Source : taxfoundation.org

The tax bite on retirement income may surprise retirees Putnam

Source : www.putnam.com

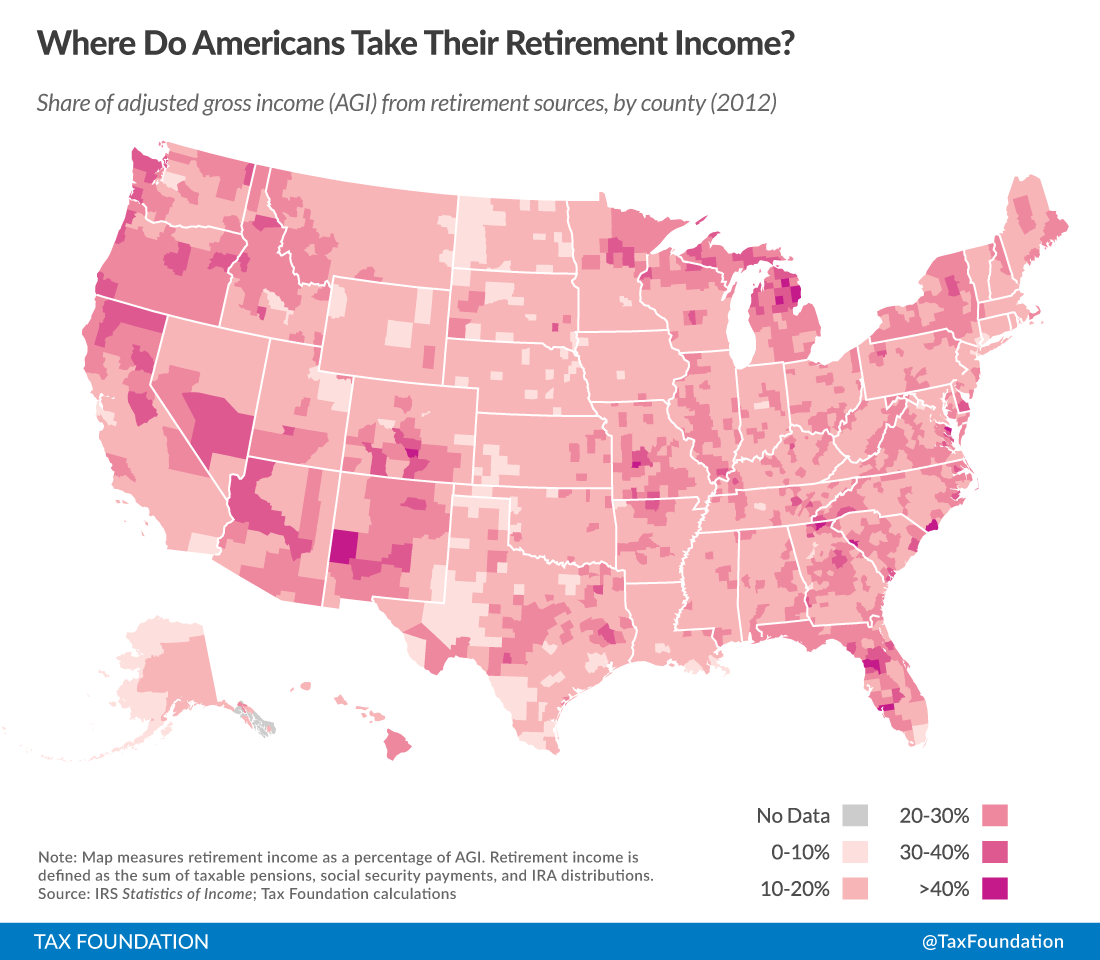

Where Do Americans Take Their Retirement Income?

Source : taxfoundation.org

Kiplinger’s Tax Map for Retirees: About Our Methodology | Kiplinger

Source : www.kiplinger.com

The most tax friendly U.S. state for retirees isn’t what you’d

Source : www.marketwatch.com

Retirement Taxes: How All 50 States Tax Retirees | Kiplinger

Source : www.kiplinger.com

States That Won’t Tax Your Military Retirement Pay

Source : www.aarp.org

Retiree Tax Map State by State Guide to Taxes on Retirees | Kiplinger: Many people dream of retirement, but the reality can be tough on a person’s mental health. Experts suggest doing these things now to have a happier, healthier “golden years.” . Super funds have changed since the Cooper inquiry recommended more independent directors. Now, it might be a case of why stop there? .